One of the real killers of a retail business can be debt. But, how much is too much?

Debt can be quite stealthy as it grows.

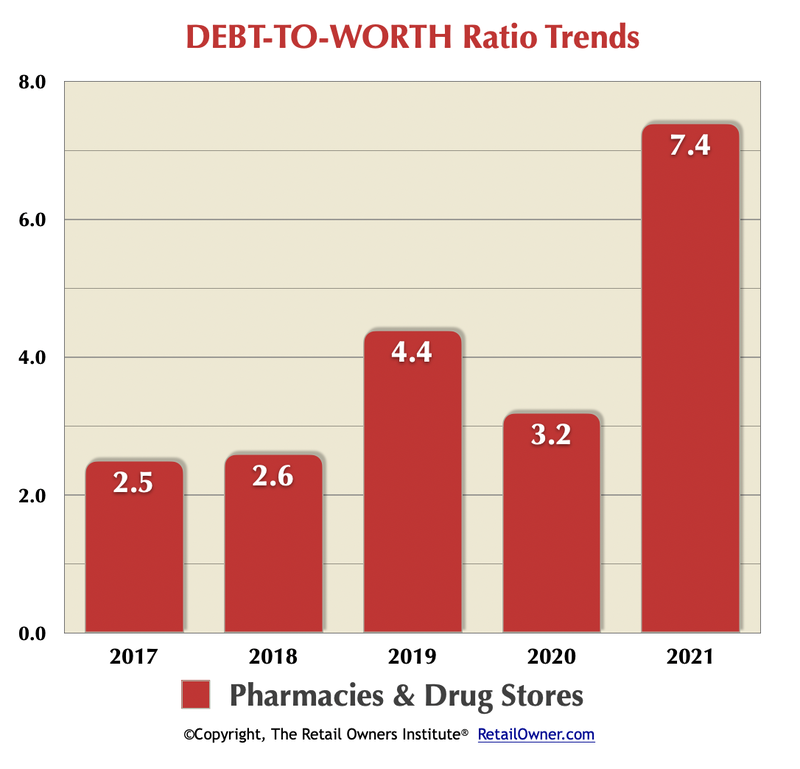

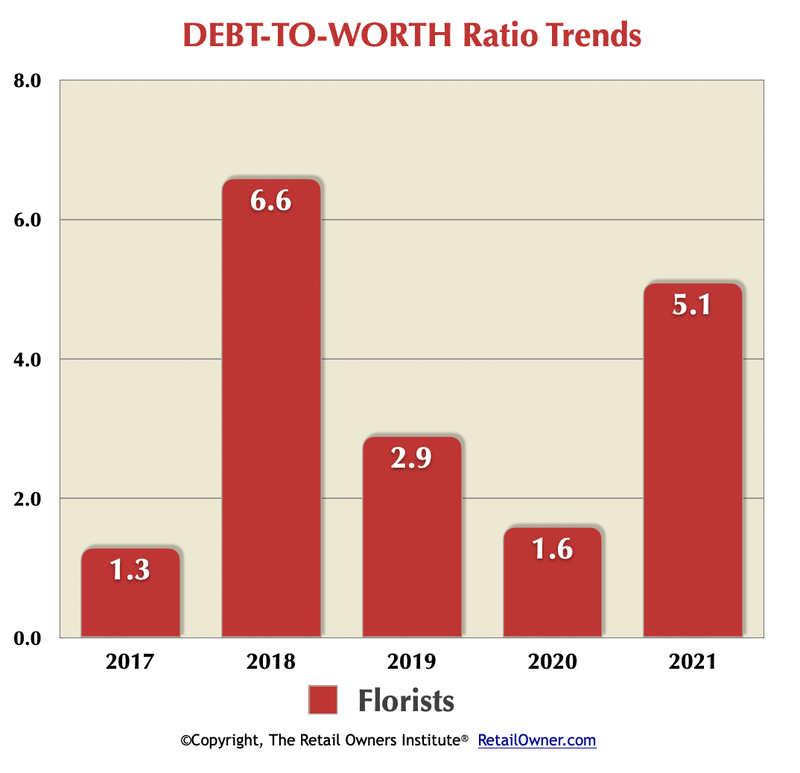

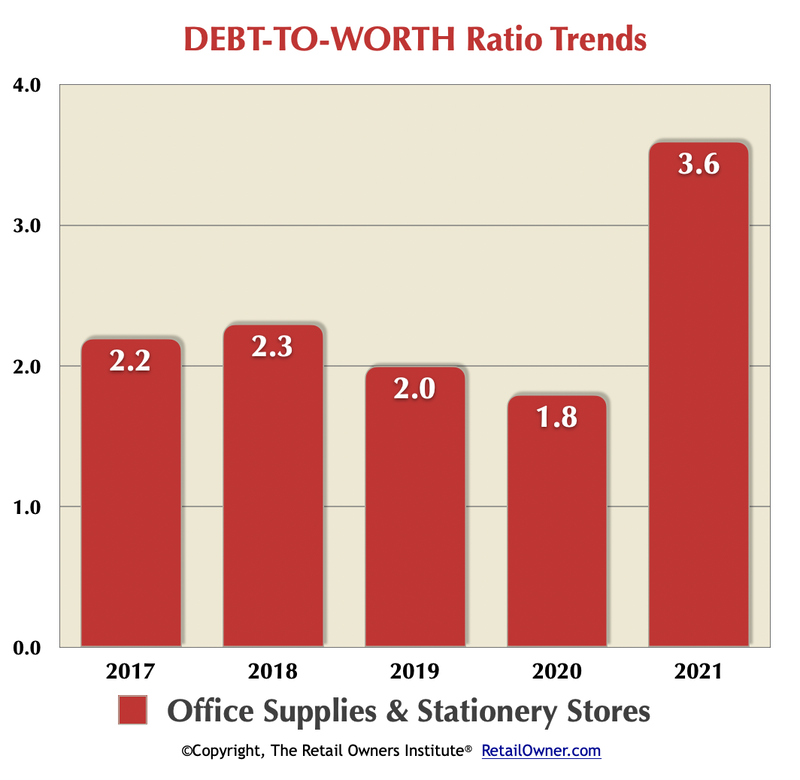

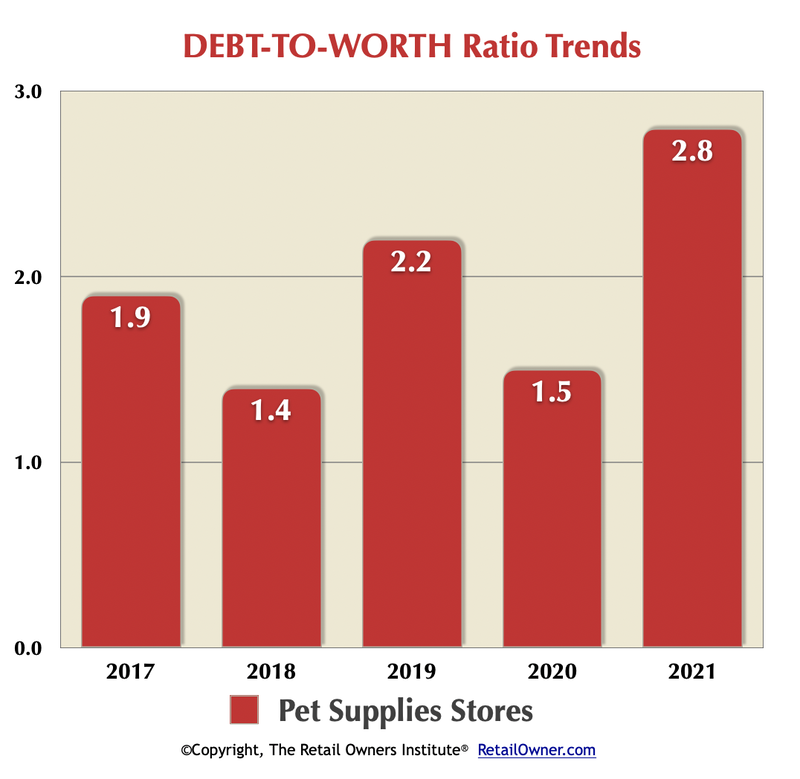

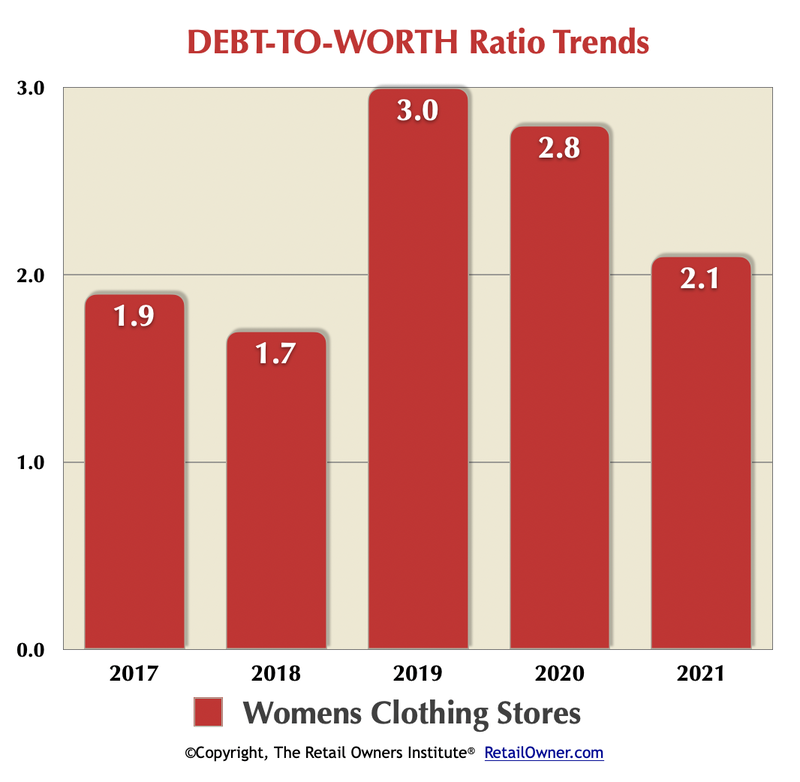

From the Benchmark pages on The ROI site, we have selected four retail verticals whose Debt-to-Worth ratio shows a frightening situation. The technical term we would use is "spooky, real spooky."

(Click on each chart to see all the key ratios for that vertical.)

Debt can be quite stealthy as it grows.

- Seemingly small expense increases add up in the aggregate – maintenance costs, security, advertising, utilities, payroll, e-commerce charges, etc.

- Vendors may be eager to offer terms, but that too is more debt. Whether or not you pay interest on it, you still are obligated to pay. And vendors would rather have an accounts receivable from you – it's an asset for them – and a debt for you.

From the Benchmark pages on The ROI site, we have selected four retail verticals whose Debt-to-Worth ratio shows a frightening situation. The technical term we would use is "spooky, real spooky."

(Click on each chart to see all the key ratios for that vertical.)

Let's keep it simple: the rule of thumb is that a Debt-to-Worth ratio of 2 to 1 (or 2.0) is generally "bankable." That is, lower than 2.0 is considered financially strong. Above 2.0 is considered financially weaker, especially when the trend of the Debt-to-Worth ratio is going up, like in the 4 retail segments shown above.

Remember, on your Balance Sheet, "debt" is OPM - other people's money. And "worth" is Owner's money. It works just like the mortgage and equity on your home.

Now is the time - mid-2022 - to be monitoring your Debt-to-Worth ratio every single month. It only takes 12 seconds – or less! Don't let it become "spooky."

Here's the formula:

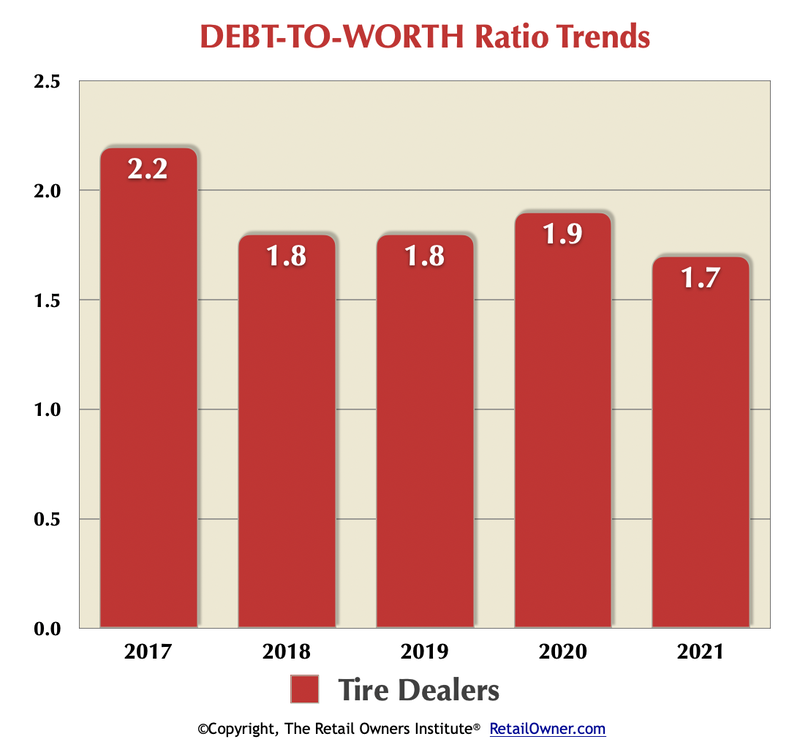

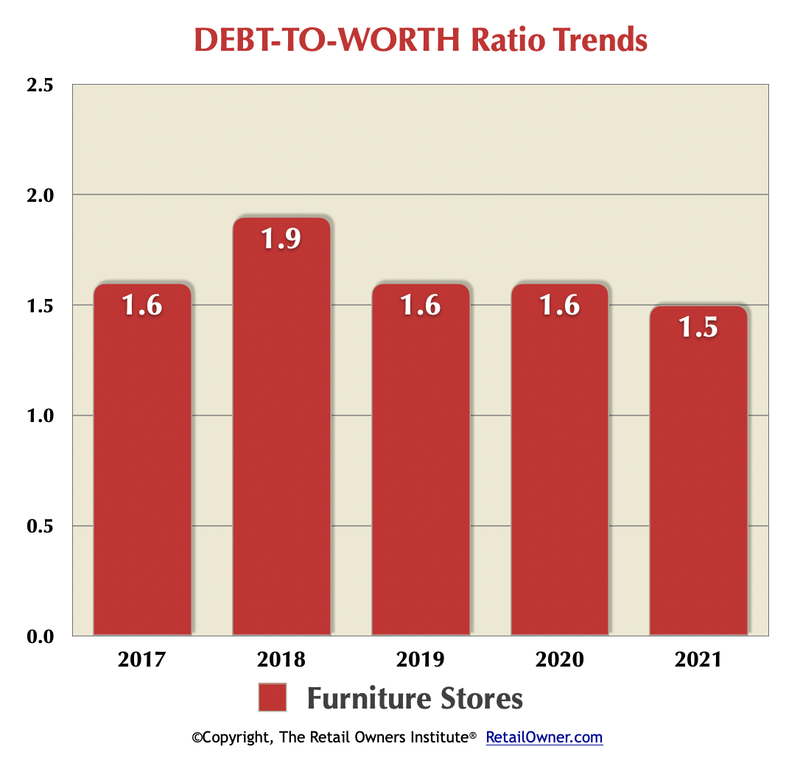

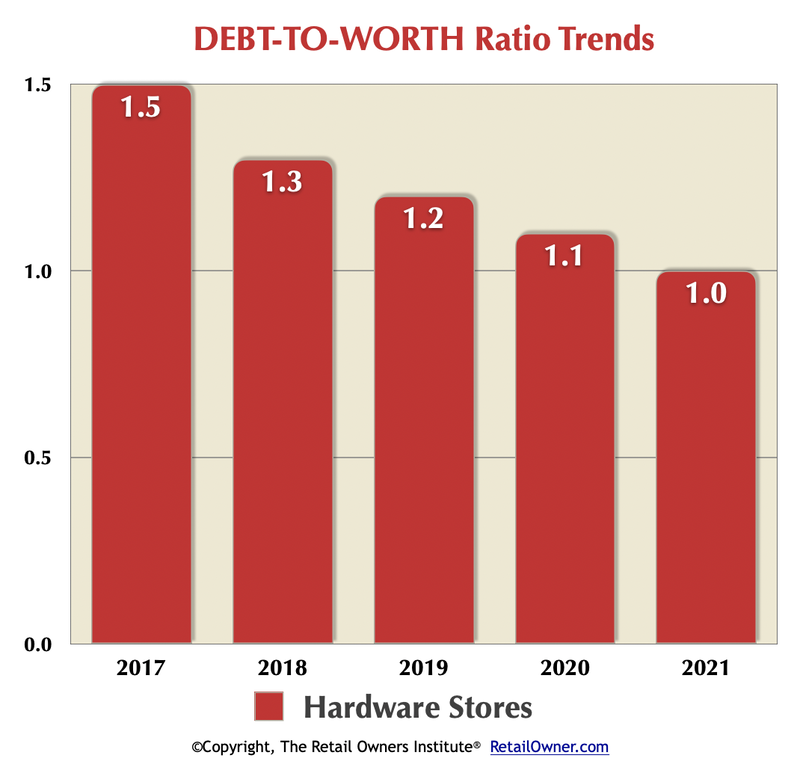

Now, look below at another 4 retail segments. They have quite a different story to tell.

Each of these verticals, given the downward trend of their Debt-to-Worth ratios, appear to begetting financially stronger.

Remember, on your Balance Sheet, "debt" is OPM - other people's money. And "worth" is Owner's money. It works just like the mortgage and equity on your home.

Now is the time - mid-2022 - to be monitoring your Debt-to-Worth ratio every single month. It only takes 12 seconds – or less! Don't let it become "spooky."

Here's the formula:

- On your Balance Sheet, first add up all of your liabilities, all of the current liabilities and all of the long-term liabilities.

- Divide that Total Liabilities number by the dollar amount of the Net Worth or Equity in the business.

Now, look below at another 4 retail segments. They have quite a different story to tell.

Each of these verticals, given the downward trend of their Debt-to-Worth ratios, appear to begetting financially stronger.

For all the 54 retail segments tracked on The ROI site, the average for 2021 was 2.1; the median(half above, half below) was 1.9.

That's interesting, but not really significant.

What does matter? Your Debt-to-Worth ratio, and the trend of it. Are you getting financially stronger, or weaker?

All it takes is 12 seconds, once a month.

That's interesting, but not really significant.

What does matter? Your Debt-to-Worth ratio, and the trend of it. Are you getting financially stronger, or weaker?

All it takes is 12 seconds, once a month.