Undoubtedly you'll agree with this. We read and hear a lot in the business press, but we treat 100% of it rather skeptically.

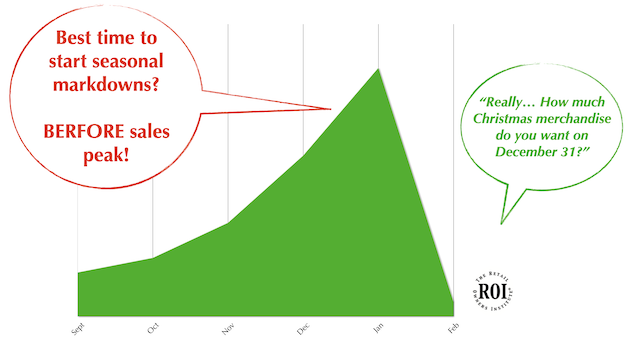

And so it is with articles and commentary about this coming Holiday Season, specifically about retailers' inventory and margins.

Nevertheless, there is considerable good news being trumpeted. Most recently, this feature article in the Wall Street Journal: "Retailers Hone Inventory for Holidays" *

And so it is with articles and commentary about this coming Holiday Season, specifically about retailers' inventory and margins.

Nevertheless, there is considerable good news being trumpeted. Most recently, this feature article in the Wall Street Journal: "Retailers Hone Inventory for Holidays" *